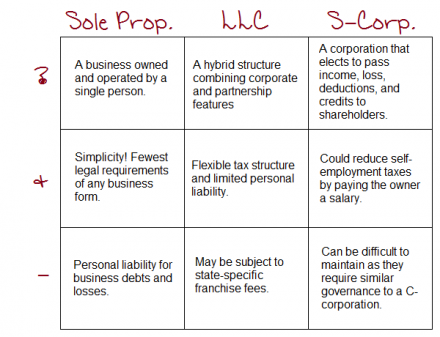

One of the most common questions I get from entrepreneurs is how they should initially set up their business. Should they incorporate? Will a sole proprietorship work to get started? Can they change forms later? What are the tax implications?

I will answer these questions with a three-part series discussing the most common forms of business used by entrepreneurs: the Sole Proprietorship, the Limited Liability Company, and the S-Corporation. For each, I will explain what it is, list the pros and cons, and explain some of the tax considerations.

What is it?

A sole proprietorship is a business owned and operated by a single individual. There is no legal distinction between the individual and the business.

“Doing Business As”(“DBA,” “dba,” “d/b/a”) is a legal term indicating that an individual (you) is doing business under a different name (the name of your company). These are also called “trade names” or “assumed names”. For example, your name is Kelly Green and you set up a business making letterpress greeting cards and call it “KG Creations”. You need to register the name “KG Creations” as your DBA name.

For purposes of consumer protection, various jurisdictions require you to include a DBA statement (which may have to be run in a local newspaper).

How do I do it?

You are probably already doing it. If you are freelance, taking jobs on a contract basis, or other independent contractor not on an employer payroll, you are automatically a sole proprietor. Your city may require you to register, so check with your local tax jurisdiction.

Pros:

- Simplicity. In comparison with the other forms in which you can do business, this form has the fewest legal requirements and the least amount of regulatory paperwork.

- Speed. Sole proprietorships are comparatively quick to establish.

Cons:

- Personal liability for business losses. The sole proprietor has unlimited responsibility for all business losses and debts.

- Your bakery business owes the flour merchant $400 but you only have $350 in the bank? You are personally responsible for the extra $50 to make up the difference.

- Someone gets hurt using your product and sues? You are personally on the hook for any monetary settlements if your business is unable to cover them.

- Lack of continuity. Corporate entities last beyond their creator. Sole Proprietorships, however, tend to die with their creator. This is especially relevant if you are looking to pass your small business on to children or other partners.

-

- If you operate a sole proprietorship in your name and later become unable to continue business as usual, there is a greater legal hurdle should someone else hope to pick up the business in your stead.

- This could cause problems for your reputation and viability if your business is seen as being unable to maintain continuity (e.g., in paying bills, producing quality products, responding to customer inquiries, etc).

- If business succession is a concern, get everything spelled out up front so there is no confusion after you are gone!

- If you operate a sole proprietorship in your name and later become unable to continue business as usual, there is a greater legal hurdle should someone else hope to pick up the business in your stead.

- Perception is reality. Outside entities (customers looking to purchase your goods or services, banks looking to fund you) generally see incorporated entities as more “serious” than sole proprietors. It is easier to get funding as a business than a sole proprietorship.

Tax Considerations:

- Income or losses are reported annually on the Form 1040, Schedule C.

- Sole proprietors are personally responsible for withholding and paying income taxes.

- This means you will have to pay Self Employment Taxes on Form 1040, Schedule SE.

- Sole proprietors are also responsible for Estimated Taxes. This amount represents the taxes on any business income earned during the year and is reported quarterly