The thing that tends to cause the most stress and uncertainty in a new business is the money. Will there be enough? How will we track it? Are there tax consequences?

I get it, believe me.

But I also believe that you can get it, too.

First, just get started.

Those expenses aren’t going to track themselves! Luckily, there are several software options available to help you keep tabs on your money and provide you with a snapshot of how your business is doing – from a financial perspective – every day. Grab that pile of receipts and dive in. You want to be recording:

- Invoices (how the money comes in). Having all your invoices in one place is crucial to keep track of who has paid, who still owes you money, and who to reach out to in the future if your business is cyclical.

- Expenses (how the money goes out). Expense tracking is going to be worlds easier if you have a separate bank account for your business and use a related credit or debit card for every business-related purchase. As different types of expenses have different tax implications, you should be categorizing these amounts. Most bookkeeping software will prompt you with options or, if in doubt, just reach out to your CPA.

Keep going.

Now that you have a system in place for tracking the income and expenses for your business, keep at it. It will always be less-stressful in small doses so take care of paying bills and tracking receipts as they come in.

Throughout the year, there may be slow times for your business. This happens to everyone and is not a sign that your business will go bust. Keep your focus on yourself – avoid the temptation to peek at how your competitors are doing – and continue to make magic. Use the slow time to invest in yourself – read up about retirement savings options or consider other ways to market yourself to your ideal clients.

Reflect and adjust.

So, the year is over. How did you do? Take time to look back on how the year went from a money perspective.

- Are your rates competitive? Should they be raised to reflect a changing market or your increased education and experience?

- Are you selling the volume you expected?

- Were your expenses higher than anticipated?

- Could you save money by outsourcing certain tasks so you can focus on the main business?

Take the time to create a budget for your upcoming year and talk to your accountant about how you can make next tax year better.

Never confuse your income with your worth.

While you may pour your heart and soul into your business, it alone does not define you. Yes, we all need money to buy food and pay rent. That’s an important thing, but that’s not the only thing. You are more than money.

—

When I first knew I was leaving my corporate job, I immediately reached out to Michelle Ward. I’ve also shared my experience with quitting my day job on her wonderful blog. Michelle is a cheerleader for the unsure – helping them transform their fear into dream careers.

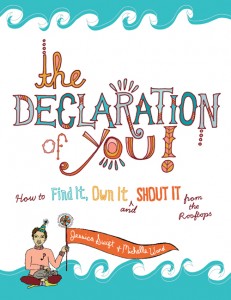

Recently, Michelle and co-author Jessica Swift have put out a book called The Declaration of You:

This book gives readers all the permission they’ve craved to step passionately into their lives, discover how they and their gifts are unique, and uncover what they are meant to do. When Michelle asked me to be part of the Declaration of You BlogLovin’ Tour – a tour of personal declarations of over 200 creative entrepreneurs – I said “Yes!” immediately. Learn more here.